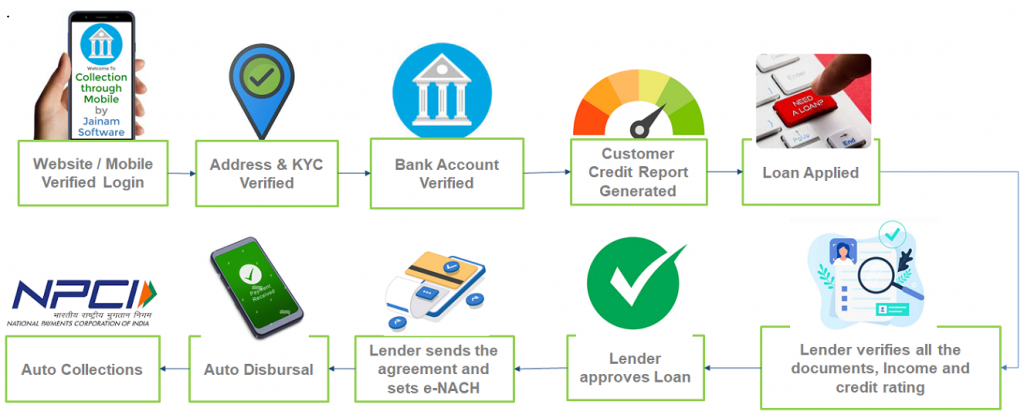

1. Customer Login

Loan Originating System should provide web application or mobile application where end user can registered mobile number and generate self login.

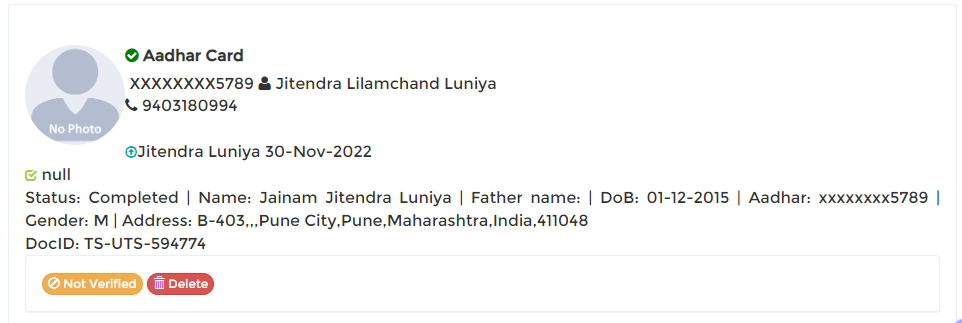

2. eKYC Check

Know Your Customer (KYC) check is mandatory process because it is used in many other integrated system for verification, reports and loan recovery. An automated KYC is the recommended solution for digital lending platform.

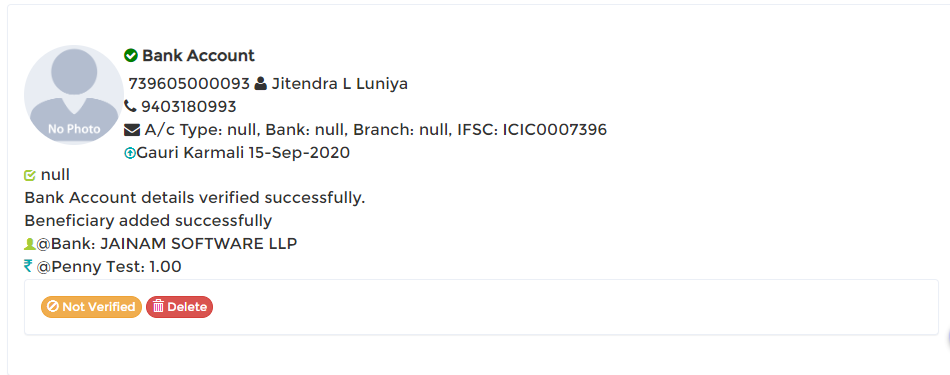

3. Bank Account Verification

Bank account verification is required in digital lending because it is used to process the payout and also register with National Automated Clearing House (NACH).

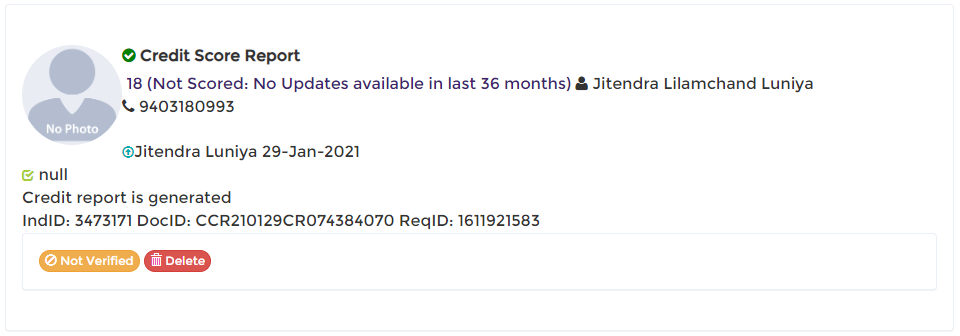

4. Credit History Check

Credit history check helps to decide the customer rating and loan repayment capabilities. Based on customer credit score, loan amount, rate of interest and tenure is defined. Credit history report can be fetched from TransUnion CIBIL, CRIF Highmark, Equifax or Experian credit bureau agencies.

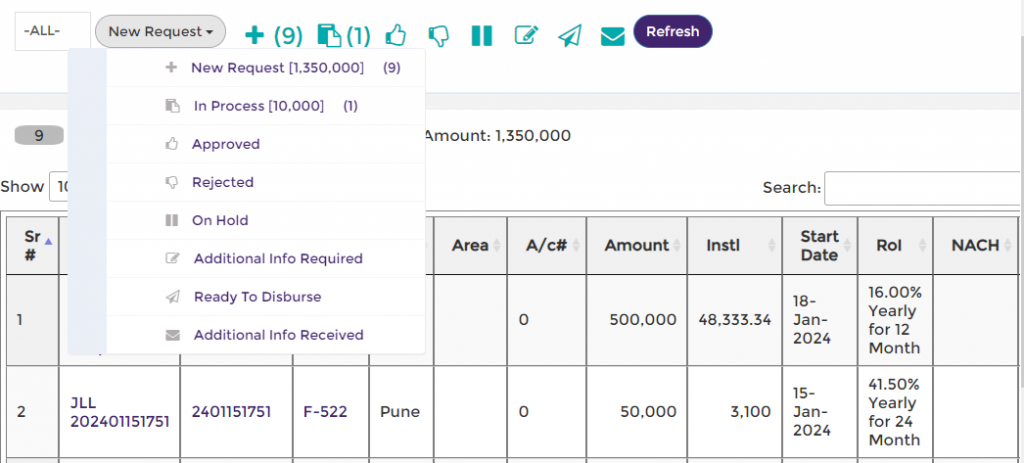

5. Loan Application

Once customer’s basic checks and verifications are done, customer is allowed to submit loan application which flows in Loan Management System (LMS) for approval.

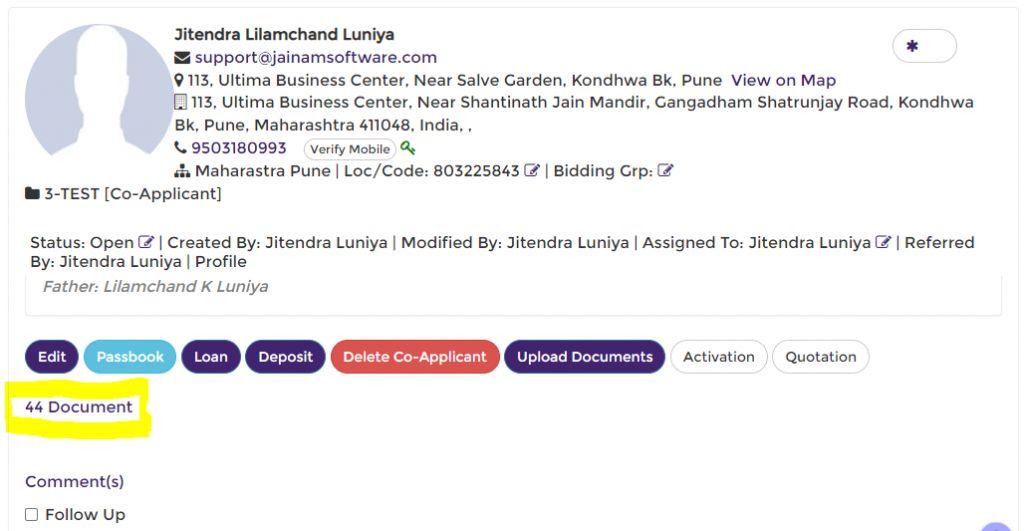

6. Document Verification

Documents like bank statement and loan specific documents like vehicle or property information once filled can be verified manually or automated model.

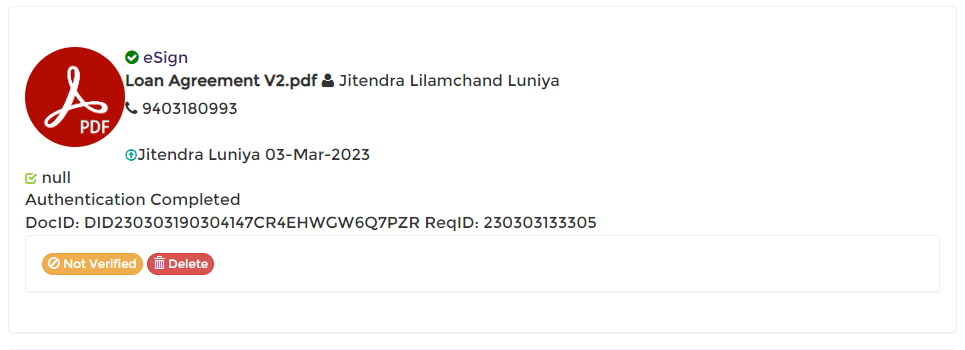

7. Loan Approval and Agreement

Once the documents are approved then loan gets approved. Upon loan approval a loan schedule is prepared in Loan Management System so that loan agreement can be prepared and shared for signing. The agreement in Digital Lending can be signed digitally using eSign on e-Stamp papers as per state government rules and regulations.

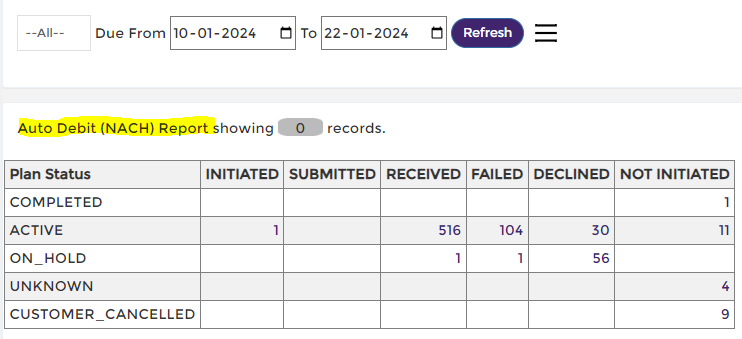

8. Automated Collection using NACH

Loan recovery is the most challenging part in any finance business. During loan origination, it is recommended to get automated recovery completed using eNACH to avoid any manual effort in loan recovery. The system should be capable enough to handle all the automated processes related to failure of automated collection.

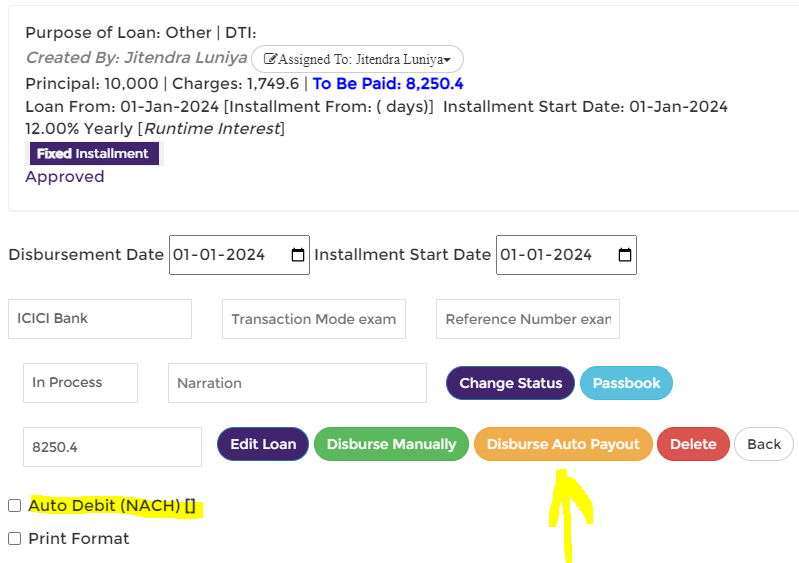

9. Auto Disbursement

The final stage of loan origination system is to transfer loan amount from merchant account to customer account. Most of the cases it is done manually but in Digital Lending this process is automated so that the delay in finance and disbursement can be reduced. The bank account verification is used for auto disbursement.

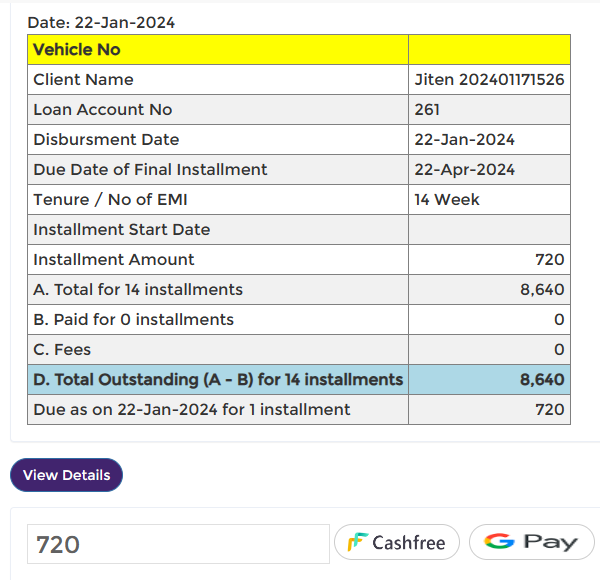

10. Loan Account Details via Customer Mobile App

Through out the loan origination and processing system customer should have mobile app to know the exact loan status so that it builds the trust and provides transparency in loan management system. After loan approval and disbursement, customer should know their loan card or schedule and should be able to make payment whenever required.

This provides a complete loan origination system along with integration with loan management system in digital lending platform.