Lending software plays a crucial role in the efficient management of lending processes for financial institutions. The features required in lending software can vary depending on the specific needs and goals of the lending institution. However, here are some key features that are commonly found in effective lending software:

- Loan Origination System (LOS):

- Streamlined application process for borrowers.

- Integration with credit bureaus for credit checks.

- Customizable forms and workflows to accommodate various loan types.

- Document Management:

- Secure document storage and retrieval.

- Document tracking and version control.

- Compliance with document retention requirements.

- Automated Underwriting:

- Rule-based decision engines for automated underwriting.

- Risk assessment and scoring models.

- Integration with external data sources for additional risk evaluation.

- Loan Servicing:

- Automated repayment schedules and amortization.

- Integration with payment gateways for seamless transactions.

- Escrow management for handling taxes and insurance.

- Risk Management:

- Real-time monitoring of loan portfolio performance.

- Early warning systems for potential defaults.

- Tools for stress testing and scenario analysis.

- Credit Scoring and Decision Analytics:

- Credit scoring models for assessing borrower creditworthiness.

- Analytics tools for evaluating the impact of different factors on loan performance.

- Compliance Management:

- Tools to ensure compliance with regulatory requirements.

- Automated compliance checks and reporting.

- Adherence to fair lending practices.

- Workflow Automation:

- Streamlined and automated approval workflows.

- Task automation for routine processes.

- Notifications and alerts for key milestones and events.

- Customer Relationship Management (CRM):

- Centralized customer profiles with historical data.

- Communication tracking and customer interaction history.

- Integration with marketing and customer communication tools.

- Reporting and Analytics:

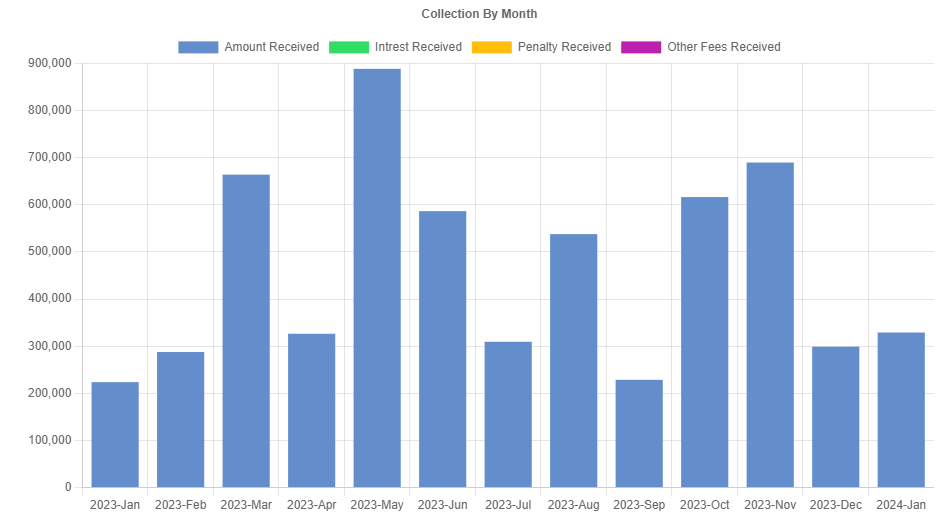

- Customizable reports on loan portfolio performance.

- Dashboards for real-time data visualization.

- Ad-hoc reporting for specific analysis needs.

- Mobile Accessibility:

- Mobile-friendly interfaces for borrowers and lenders.

- Mobile app support for on-the-go access.

- Security and Compliance:

- Data encryption and secure access controls.

- Compliance with data protection regulations.

- Regular security audits and updates.

- Integration Capabilities:

- Integration with third-party services such as credit bureaus and payment processors.

- Compatibility with other internal systems (core banking, accounting, etc.).

- Audit Trail:

- Comprehensive audit trail for tracking changes and user actions.

- Logging and reporting of all system activities.

- Scalability:

- Ability to scale the software to accommodate growth in loan portfolios.

- Support for additional features and functionalities.

It’s important for lending software to be flexible and customizable to meet the specific needs of the lending institution. The adoption of these features can improve efficiency, reduce risks, and enhance the overall management of lending processes. Additionally, compliance with regulatory requirements is crucial, and the software should be able to adapt to changes in regulations.