Loan origination is the process by which a borrower applies for new loan, and a lender processes that application. Loan Origination System is responsible for managing everything from pre-qualification to the approval of funding the loan. For any Lending business, the first step is the Loan Origination process.

9 stages of Loan Origination System in Jainam Software

Below are the stages of Loan Origination process in Jainam Software : Loan origination process starts with the Financers website.

Stage 1. Create Login and Registration

Borrower creates a login using his mobile number or email. Mobile Number and email is first verified to create the login. Borrower uses the login credentials to login. This is also known as the registration process. Where the Borrower is registered in the system.

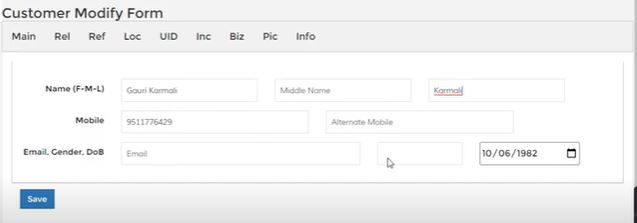

Stage 2. Customer Personal Details form

At this stage the Borrower fills up the personal details using the customer entry form.

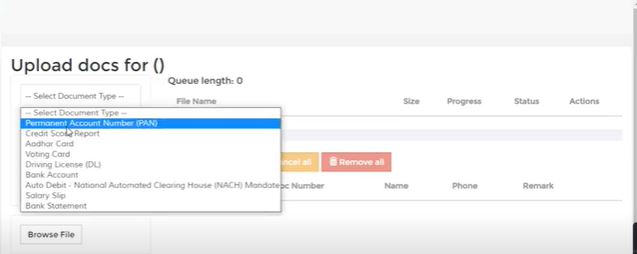

Stage 3. Document Upload

In this stage the customer, Uploads all the documents requested by the financier like PAN Card, Aadhar card, Voting Id, Driving License etc

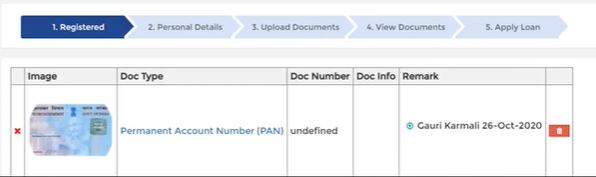

Stage 4. View Documents

This is a very important stage where the Borrower can view all the uploaded documents. At this stage the borrower can check if the right documents will be submitted.

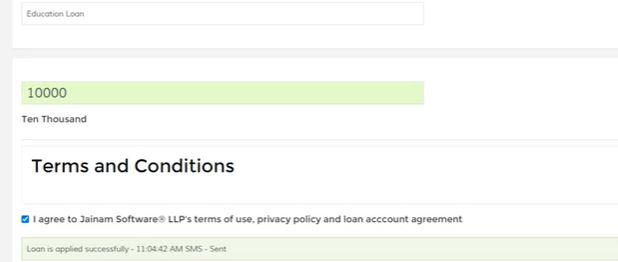

Stage 5. Apply Loan

In this stage, the borrower completes the loan application form. Jainam Software provides an automatic platform to apply for loans which makes this stage entirely paperless.

Stage 6. Application Processing

At this stage, the application is received by the credit department and the first step done by the department is to review it for accuracy, genuine & Completeness. Digital e-KYC verification is provided by jainam software to automatically verify all the documents uploaded by the borrower. If the documents are not verified and all the required fields are not completed, the application will be returned to the borrower. An sms will be sent to the borrower and the same status will reflect in the borrowers login.

Stage 7. Underwriting Process

When an application is totally completed, the underwriting process begins. Lender checks the application taking a variety of components into account: credit score, risk scores, and many lenders generate their own unique criteria for scoring that can be unique to their business or industry. Underwriting process in jainam software is fully automated with the help of a rule engine & API integrations with Credit scoring engine’s (CRIF, CIBIL, EXPERIAN etc. ) in LOS. In a rule engine of Jainam software, the lender can load underwriting guidelines specific to products.

Stage 8.Credit Decision

Depending on the results from the underwriting process, an application will be approved, denied or sent back to the originator for additional information. All this is done automatically through Jainam software rich API’s.

Stage 9. Loan Funding

Final stage is the loan disbursement when the entire loan application is approved. Jainam software LOS feature can track funding and ensure that all necessary documents are executed before or together with funding.

Lenders use jainam software LOAN ORIGINATION SYSTEM (LOS) feature to know the creditworthiness of the borrowers, to approve and disburse the loan.. The LOS feature of Jainam Software will help a lender setup workflows to a loan. It can automatically flag files with missing required fields, return it to the borrowers and notify the sales/Credit department to rework.

8,679 responses to “Stages of Loan Origination”