1:To upload the document you should purchase the software.

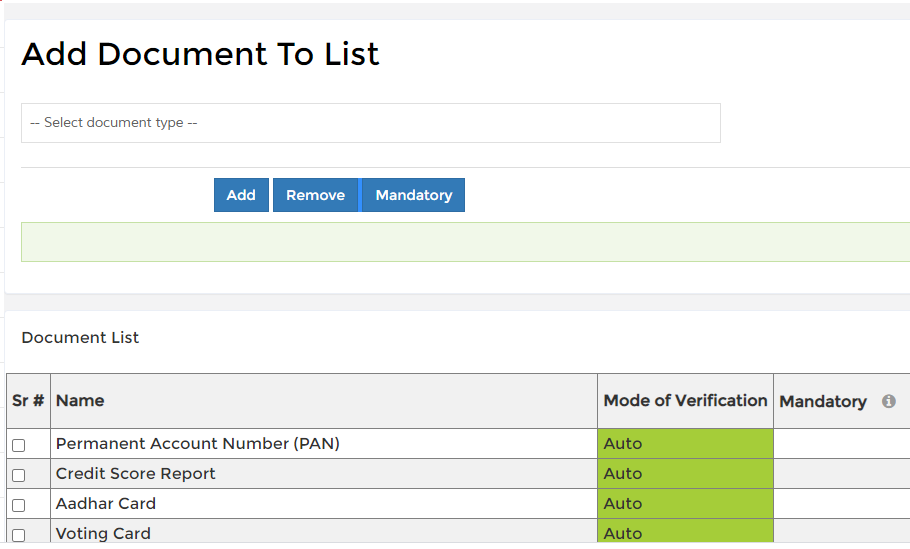

2: If you have already purchased the software then you should first create list of documents from master setup menu document list option.

Jainam Software Provides automated digital platform, that helps companies to improve operational efficiency, provides greater transparency, faster response times and better custom experience. Jainam software provides E-KYC third party service which is integrated through API . Using this service automated document verification will be done. It saves your business from fraudulent activities. So Jainam Software Plays a vital role in this service . You can verify your customer document with qovernment sites using our e-kyc service. For that we need to keep documents on auto mode.

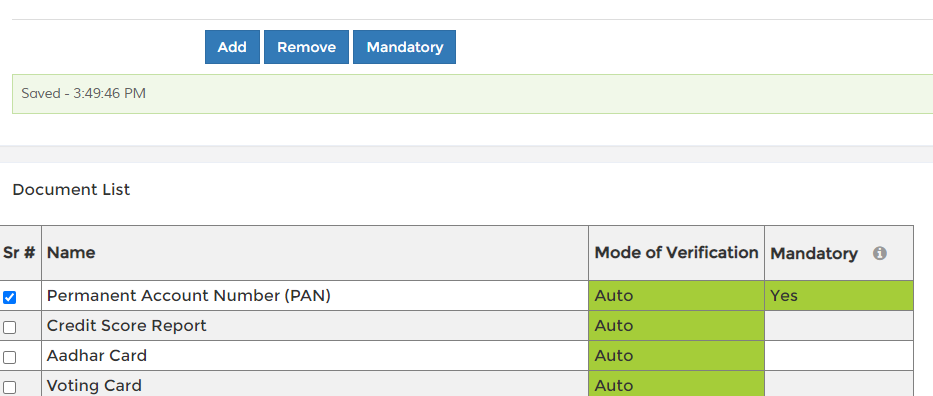

3:Benefit of mandatory Document option, that financier will not be able to create loan. If you have added documents mandatory then you need to add mandatory documents for further procedure according you business rules

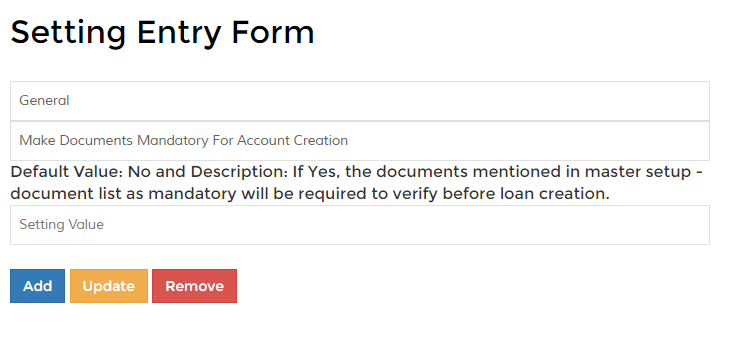

5:If you have added this setting yes, you will not give the option to create a loan until you upload the document in the system. Go to master setup > setting > General

6:If you have added this setting no, system will allow to create loan to financier

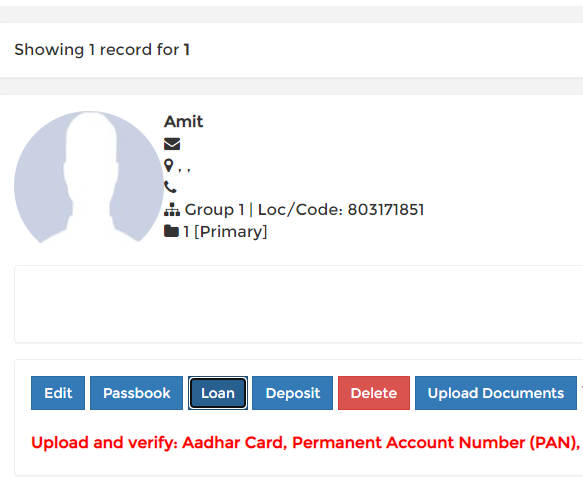

7: Then you can search customer and click document upload Button.

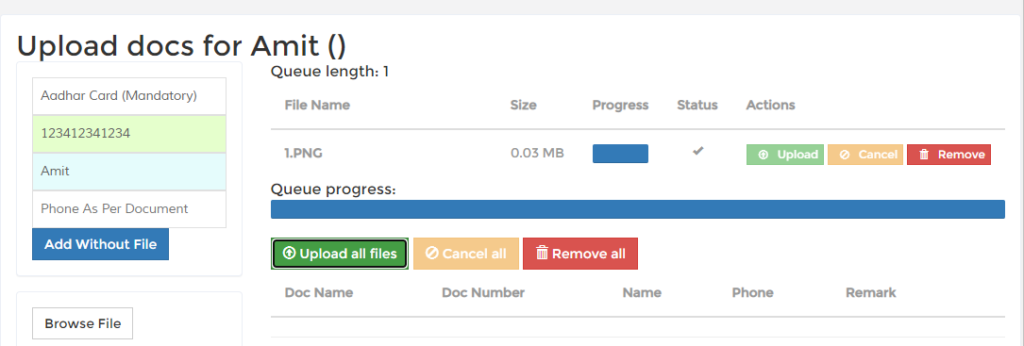

8: Please note you have to select the document type and enter document number and then click browse document.

9:We have on -boarding Feature also. Customer themselves can onboard using his or her login details, then customer can upload Document.

Borrower creates a login using his mobile number or email. Mobile Number and email is first verified to create the login. Borrower uses the login credentials to login. This is also known as the registration process. Where the Borrower is registered in the system.

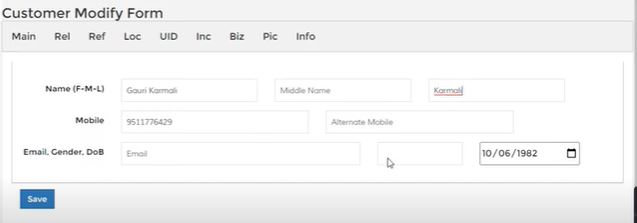

10:At this step the Borrower fills up the personal details using the customer entry form.

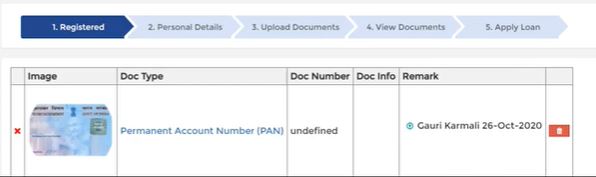

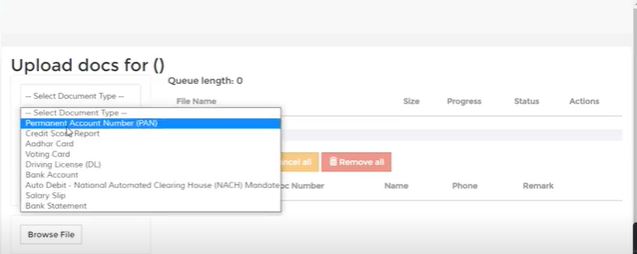

12.In this step the customer, Uploads all the documents requested by the financier like PAN Card, Aadhar card, Voting Id, Driving License etc

13.This is a very important step where the Borrower can view all the uploaded documents. At this stage the borrower can check if the right documents will be submitted.