Different GST configuration level in Jainam Software. GST configuration is defined in 3 levels. Top most level is company level second is Branch level and the lowest level is product scheme.

So GST will be auto calculate based on company state code and party state code. First you need to define company state code from Master set up > Company. Then every party must be defined with state code, So system can detect whether to apply C-GST, I-GST or S-GST.

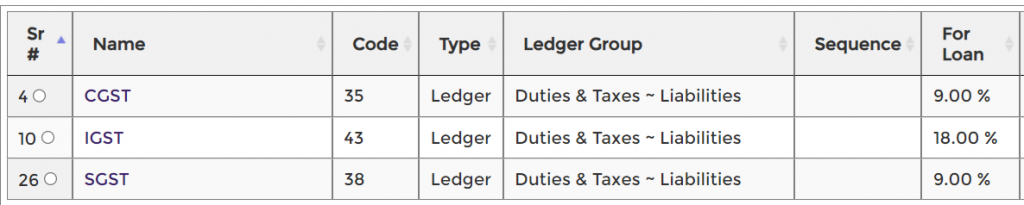

If you want to define GST in company level you need to go to Ledger > Add to favorite. You can add your favorite ledgers in list or you can create your required ledger. Click on refresh button and search for GST. For C-GST you can configure percentage. You can also configure document charges & processing fees and other ledgers.

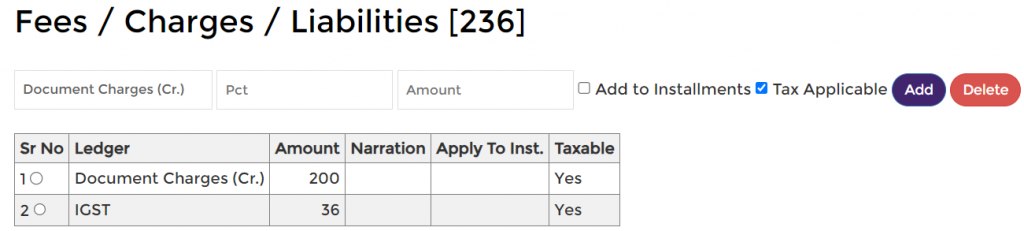

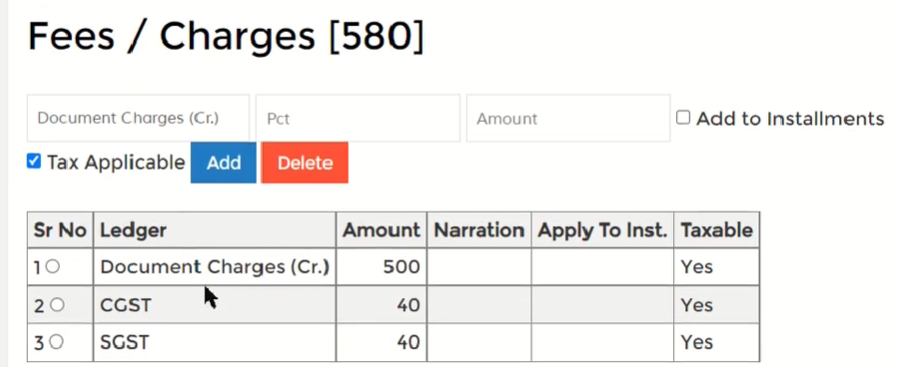

After that you can search customer, lets say customer is from Maharashtra that is state code is MH. Company Code you can defined according to your company location. For example lets say RJ for Rajasthan. Then click on loan and select product scheme if configured, and you can see tax configuration will come automatically in Fees & Charges.

If party is from other state only IGST is calculated. If customer is belong to other state than company, then IGST will be applicable.

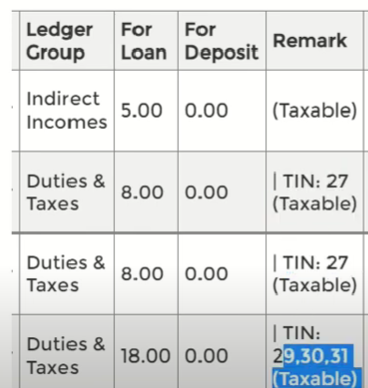

You can configure ledger from Branch level when your business is in different branches in different states.

Branch Level Configuration

If Customer is belong to same state then CGST & SGST will be applicable.

Please watch above video to understand end to end process.

https://youtu.be/m6w-cJxPUIs?feature=shared

We are happy to help you!

NBFC, Small Finance Bank, MFIs, Credit Co-operative Society, Nidhi, Chit Fund, Group Finance, Hire Purchase, Recovery Agency, Daily, Weekly, Monthly Collection Company, Insurance Company, Money Lenders, Susu Company, Credit Officer Collection, RD, FD, Savings.

Email : support@jainamsoftware.com

Thank You.